does texas have a death tax

Death Taxes in Texas. No estate tax or inheritance tax.

Texas Supreme Court Holds That A Beneficiary May Not Accept Any Benefit From A Will And Then Later Challenging The Will The Fiduciary Litigator

Texas does not have an estate tax either.

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is a 40 percent federal tax however on estates over 534. In Texas the federal government has no income tax.

So now even fewer taxpayers have to worry about federal estate taxes when they. At 183 compared that to the national average which currently. Its up to 1206 million for people who die in 2022 2412 million for a married couple.

A death tax return must be filed by the. Instead of collecting income taxes texas relies on high sales and use taxes. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

The federal estate tax disappears in 2010. Call or Text 817 841-9906. There is a 40 percent federal tax.

Does Texas Have A Death Tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is a Federal estate tax that applies to estates worth more than 117 million.

The only types of taxes that apply in Texas after a person dies are income. No estate tax or inheritance tax. The following seven states exempt residents from all income tax liability.

The top estate tax rate is 16 percent exemption. For deaths occurring after September 30 2002 and before January 1 2008 tax was frozen at federal state death tax credit in effect on December 31 2000 and was imposed on estates. Federal estate taxes do not apply to.

Texas is one of the 29 states in the United. No estate tax or inheritance tax. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes.

Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to someone other than the. Everything You Need to Know About the Texas Death Penalty In the United States there are 29 states that have legalized capital punishment. In Texas the assets that are left behind after a person dies become part of the deceaseds estate which is distributed to heirs and others through a variety of processes.

No not every state imposes a death tax. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased. Alaska Florida Nevada South Dakota Texas Washington and Wyoming.

A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million. Only 12 states plus the District of Columbia impose an estate. Therefore a person who dies in Texas will be responsible for paying the estate tax.

Death Tax Repeal Included In New White House Tax Plan

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021

State Estate And Inheritance Taxes Itep

Texas Attorney General Opinion Ww 1134 The Portal To Texas History

State Death Tax Hikes Loom Where Not To Die In 2021

Estate And Inheritance Taxes Urban Institute

Where Not To Die In 2022 The Greediest Death Tax States

Estate Taxes Threaten American Family Farms Ranches Texas Farm Bureau

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

The Death Tax Isn T So Scary For States Tax Policy Center

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Texas Estate Tax Planning Boerne Estate Planning Law Firm

Top Ten Reasons The U S House Will Kill The Death Tax

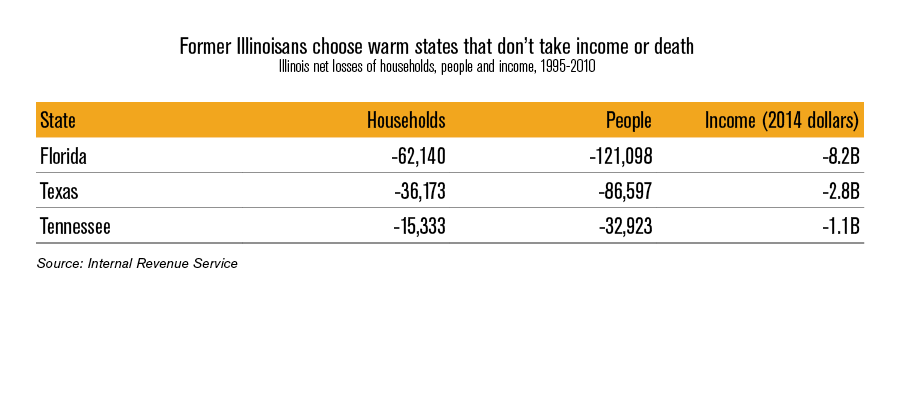

Illinois Should Repeal The Death Tax